26 Jul Insights #002: Infrastructure’s Under-Appreciated Assets

Is COVID-19 testing the defensive nature of unlisted infrastructure? The answer may lie in diversification between the different types of infrastructure assets.

Regulated assets are not considered the most exciting of the infrastructure asset classes, but the COVID-19 pandemic finds them taking on a more appreciated role within the portfolio; that of ‘durable’ and ‘reliable’.

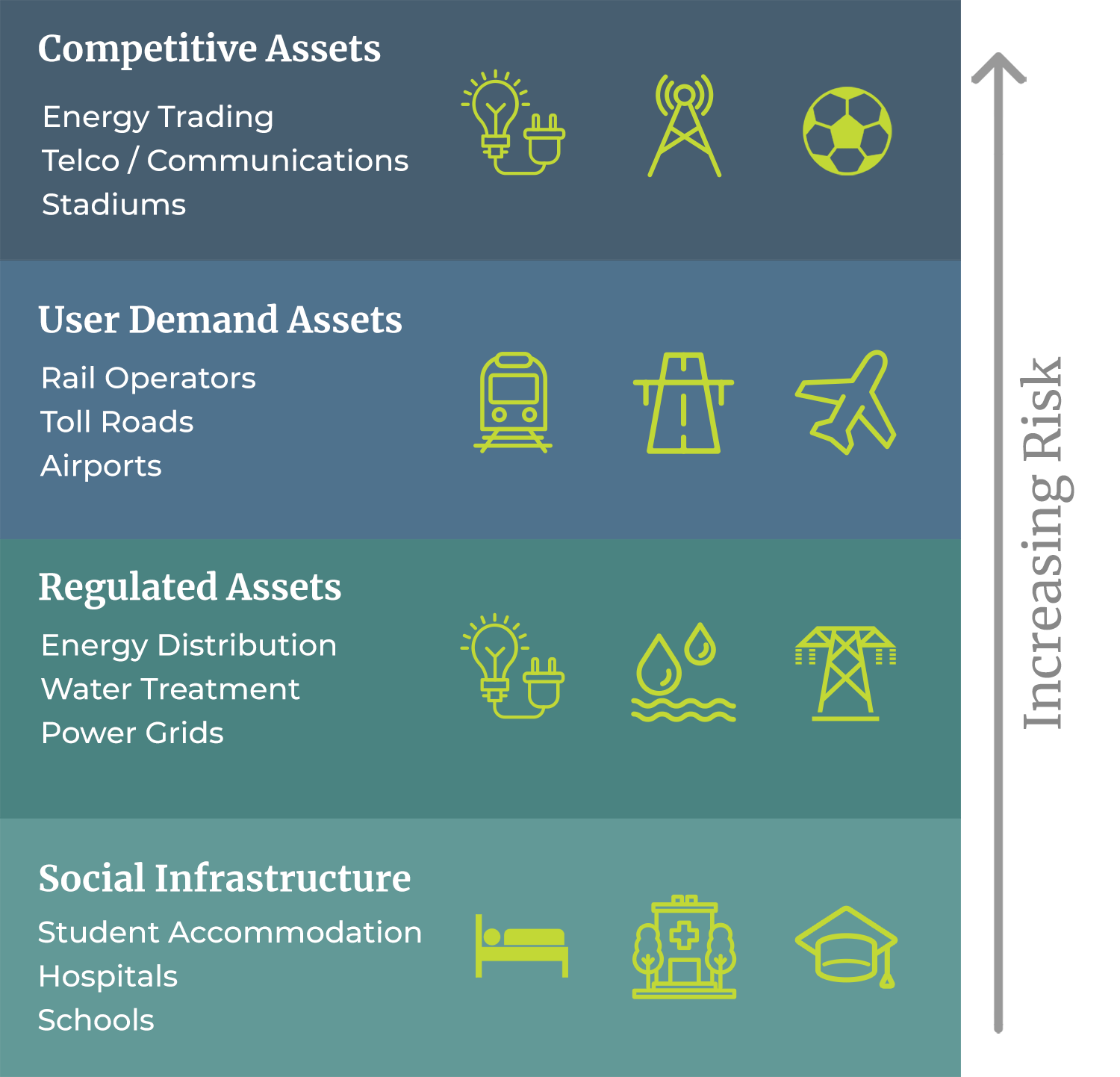

What’s the difference between regulated and other types of infrastructure assets? It first helps to understand that infrastructure can be categorised broadly into four buckets:

Social Infrastructure

These are structured financing deals backed by governments to create long-term public infrastructure assets, such as schools, tram networks and specialised hospitals. Often, these types of arrangements can be called Public Private Partnerships.

Regulated Assets

These utilities assets are characterised by a strong ’essential service’ element for the community. As returns to investors are determined by balancing the needs of the taxpayers’ and owners’ obligation to maintain the assets, independent arbiters set the price paid by either consumers or governments, therefore the return margin to investors. Examples are gas/electricity generation, distribution and retailing, as well as water distribution and waste treatment.

Economic Usage Assets

This type of infrastructure includes key assets that are needed to support the long-term growth of the economy (airports, seaports, bridges, and toll roads). These assets typically have large upfront capital costs with a long operating life and minimal ongoing capital costs. The pricing of the services provided by the assets is either established at the beginning of the contract with government or regulated by an external party. The payments faced by users of the services are typically small and/or the assets demonstrate strong monopoly tendencies. Typically, these assets exhibit a high degree of patronage risk.

Competitive Assets

This category includes infrastructure where the economies gained from sharing infrastructure outweigh the competitive advantage achieved from owning and operating your own infrastructure, meaning the owner must compete in the open market for returns. Examples are in telecommunications (e.g. satellites, mobile phone towers, cable networks and fibre networks), power generation (e.g. solar and wind farms) and entertainment venues (e.g. stadiums, which are topical during the Olympics). It is the riskiest type of infrastructure.

With individual movement being restricted as a direct result of Government policy responses of widespread lock-downs of retailers, domestic and international travel bans and work from home orders, the impact on the economy has been significant. Aircraft were largely grounded during the worst of the pandemic, toll-road usage was curtailed and in countries such as Brazil, they were unable to process their iron ore exports.

Meanwhile, substantially regulated utilities and communications have exhibited a high degree of resilience and stability of income. These boring assets (to some) are the core of our portfolio, providing services, such as the power line infrastructure to supply electricity to homes for a contracted amount, irrespective of usage. These quiet performers have proven to have steady valuations, based on solid financials and attractive cash-generating yields.

Overall, the defensive and contracted nature of these monopolistic assets within the portfolio have provided significant downside protection during this once-in-a-lifetime pandemic. For Invest Unlisted, this reinforces the importance of our optimised diversification strategy, which currently has about 30% of the portfolio in regulated entities such as the Sydney Desalination Plant, TransGrid and ElectraNet.

Even though the capital values of many other types of unlisted infrastructure investments may have taken a hit during the pandemic, long-term valuations are expected to revert, remaining strong with income returns staying attractive (especially when compared to bonds rates or term deposit yields).

In summary, COVID-19 has tested the defensive nature of both listed and unlisted infrastructure. Some direct assets such as airports have been more impacted than others, while the regulated assets within the portfolio have shown great resilience.

We believe we are heading out of the low end of the pandemic cycle, with airports set to pick up passenger traffic as borders between states reopen. This is driven by government stimulus, such as domestic tourism campaigns, pent-up demand and the likely release of peoples’ savings during a period of great uncertainty.

We think now is a good time to get in on this asset class.

About us

Invest Unlisted’s Core Infrastructure Fund is a highly diversified $200 million open-ended unlisted infrastructure fund of 35 assets with a 5-year track record. Core Infrastructure Fund was established specifically to provide SMSF investors with access to the unlisted infrastructure asset class.